TOGETHER WITH

Today’s edition is brought to you by Titan FX – the trading platform designed for precision, speed, and top-tier performance. Whether you’re trading forex, commodities, or indices, Titan FX delivers ultra-tight spreads and advanced tools to keep you ahead of the markets.

Hey, traders! Ezekiel here with fresh market insights (and a little something extra 🕵🏽♂️). Here’s what’s on the radar today:

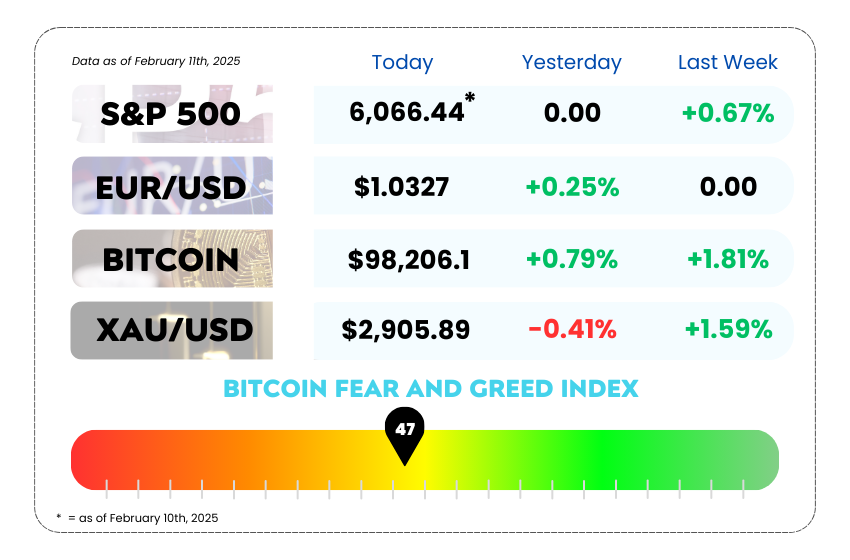

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Gold’s record surge faces one question: $3,000 next or a pullback?

• Southeast Asian markets slide as the strong dollar repels investors

• Master the Bullish TriStar Pattern for powerful trend reversals with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚀 Gold’s Tug-of-War: Inflation Fears vs. Market Mania 💰

Gold is caught in a battle between inflation jitters, Fed speculation, and a wild global economy—and it’s making history while at it. The precious metal hit an all-time high of $2,942 per ounce before taking a step back. But make no mistake: the big question isn’t if gold will hit $3,000, but when.

What’s Driving This Gold Rush?

It’s a perfect storm of economic uncertainty:

• Trade War 2.0? Donald Trump is back in the headlines, dropping tariffs on US steel and aluminum imports and hinting at more to come. Investors? They’re flocking to gold as a hedge against potential economic turbulence.

• Inflation Ain’t Dead Yet—Short-term US inflation expectations just hit their widest gap vs. long-term expectations since 2023. Translation? Markets are bracing for a longer inflation fight, making gold even more attractive.

• The Fed Factor—All eyes are on Jerome Powell’s testimony this week. If the Fed signals a slower pace of interest rate cuts, it could put the brakes on gold’s rally (since gold doesn’t pay interest). But if Powell hints at economic risks, gold could skyrocket past $3,000.

XAU/USD Daily Chart as of February 11th, 2025 (Source: TradingView)

Are We in Overbought Territory?

Gold-backed ETFs have been loading up for six of the last seven weeks, with holdings now at their highest since November. Miners are also cashing in—Zijin Mining (Hong Kong) surged 4%, and Australia’s Northern Star Resources hit a record high.

But here’s the catch: some market indicators suggest gold might be overheating. The 14-day RSI (Relative Strength Index) approached 80, a level that often signals a short-term pullback.

The $3,000 Question

Big banks aren’t shying away from bullish calls:

🔮 Citigroup predicts gold will hit $3,000 within three months

🔮 JPMorgan’s year-end target? $3,150

Even with short-term dips, the bigger picture remains bullish. As long as economic uncertainty lingers, interest rate cuts stay uncertain, and trade tensions brew, gold will remain the go-to safety play.

This gold rally isn’t just about Trump’s tariffs or Powell’s next move—it’s about a global economy searching for stability. Inflation fears, central bank policies, and geopolitical risks will keep gold in the spotlight.

The real question isn’t just how high gold can go, but how volatile the ride will be. If you’re trading gold, expect sharp swings, breakout opportunities, and market surprises.

🔑 Watch Powell, monitor inflation signals, and track the dollar index—because that’s where the next gold move will come from. 🚀

🚨 Southeast Asian Stocks Struggle Amid Dollar Surge and Policy Uncertainty 📉

Southeast Asian stocks are getting crushed, and while the mighty US dollar is taking most of the blame, it’s only part of the story. Investors are losing confidence in the region’s growth outlook, and without strong domestic catalysts, money is flowing out fast.

Markets in Thailand, Indonesia, and the Philippines are some of the worst-performing in the world this year—a sharp reversal from last year when investors flocked to the region as a supposed safe haven from global volatility. Now? The narrative has flipped.

More Than Just a Dollar Problem 💸

Yes, the dollar’s surge is making things worse—fuelling inflation, weakening exports, and pressuring central banks. But the bigger issue? Local economies aren’t doing enough to give investors a reason to stay.

📉 Jakarta’s stock market just hit a 3-year low, tumbling 17% since September.

📉 Thailand’s market is back to 2020 levels, down 15% from its October high.

📉 The Philippines’ stock market is officially in a bear market after months of selling.

US Dollar Index Daily Chart as of January 15th, 2024 (Source: TradingView)

Country-Specific Headaches Piling Up

• Indonesia’s banking sector is under pressure, and investors bailed after major stocks were left out of MSCI’s index review.

• Thailand’s government is calling for rate cuts, fearing its economic recovery isn’t as strong as expected.

• The Philippines is dealing with weak economic data, making it hard to find a reason for a rally.

What Could Turn This Around?

Southeast Asian markets need a major sentiment shift—either a weaker US dollar or stronger domestic policies that give investors a reason to come back. But with US rate cuts still uncertain, markets may remain under pressure in the short term.

The decline in Southeast Asian markets is not solely driven by the strength of the U.S. dollar. Weak economic momentum and the absence of strong policy actions are making it increasingly difficult to attract investment. Without clear growth signals or structural reforms, these markets are likely to remain under pressure.

The key factor to watch is any indication of Federal Reserve rate cuts. A weaker dollar could improve sentiment and stabilize markets, but until there is greater certainty, volatility will persist, and investors will remain cautious.

MEMES OF THE DAY

Because ‘buying and selling money’ just doesn’t sound fancy enough. 🎩

Ignore the news at your own risk… 📉💀