Hey traders, Ezekiel here with fresh market insights and a few bonus tips to take your trading to the next level. Here’s what you need to know:

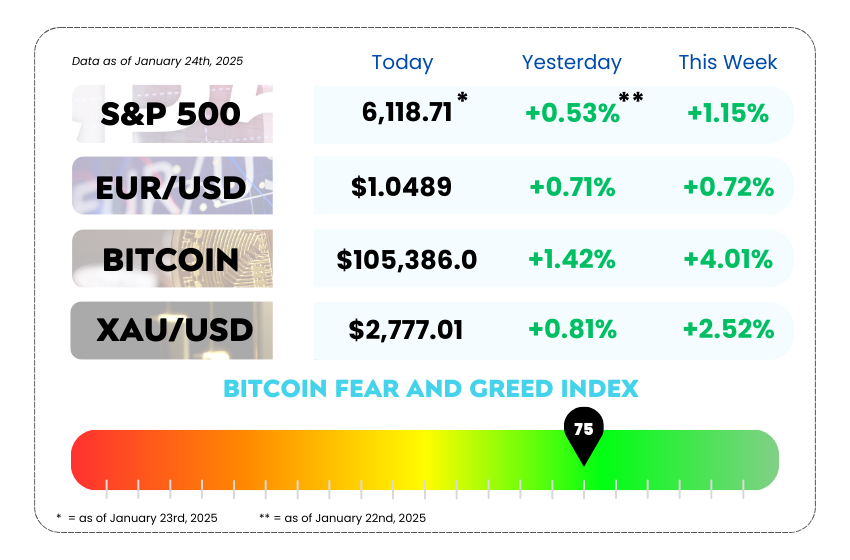

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Gold climbs to $2,774, near its record high of $2,790, as a weaker dollar and trade uncertainty fuel demand

• Microsoft’s AI push is slow, but analysts bet on long-term growth

• Spot fake market signals with the Bullish ABCD Pattern with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🏆 Gold’s Big Comeback: Is the Safe Haven Ready for a New Record? 💰

The spotlight is back on gold as it edges closer to an all-time high, trading near $2,774 an ounce. But this time, the rally isn’t just about a weaker dollar—it’s a signal of deeper uncertainty rippling through global markets. 🌍

Former President Donald Trump’s recent remarks about tariffs on China may have triggered this week’s movement. His softer stance on trade tensions pushed the dollar down 0.7% 📉, making gold more attractive for global buyers. However, the real story lies in the growing appetite for gold as a hedge against economic turbulence.

Why Gold Is Grabbing Headlines (Again) 🌟

Gold has climbed nearly 3% this week, fueled by what analysts call a “perfect storm” of market drivers:

- Trade Policy Uncertainty: Trump hinted at avoiding harsh tariffs on China but raised the possibility of levies on Europe. The unpredictability keeps investors on edge. 🤔

- Federal Reserve Watch: Trump is calling for rate cuts, but the Fed’s next move remains unclear. Any shift in rates could shake up both the dollar and gold prices.

- Safe Haven Demand: With geopolitical tensions rising and questions swirling about global economic stability, gold is cementing its role as a trusted refuge for investors.

XAU/USD Daily Chart as of January 24th, 2025 (Source: TradingView)

Gold’s Role in a Changing Economic Landscape

Gold’s resurgence reflects more than just market moves—it signals a shift in how traders are approaching risk. With tariffs threatening supply chains and global inflation on the rise, the economic outlook is murky.

Trump’s calls for lower interest rates, coupled with a push for US-centric manufacturing, add layers of complexity for the Federal Reserve and global investors.

While gold has traditionally benefited from weaker dollar conditions, its role as a hedge against volatility and economic uncertainty is becoming even more prominent. The metal’s momentum may have more to do with macro risks than momentary market shifts, according to analysts.

The Big Takeaway for Traders 📊

Gold’s recent moves are a reminder that it thrives in uncertain times. Whether it’s trade disputes, central bank policies, or inflation fears, gold is likely to remain a focal point for investors looking for safety in a turbulent market.

Gold’s rally this week underscores its power as a hedge in uncertain conditions. For traders, here’s what to watch:

• Trade Policy Developments: Any shifts in tariff talks or trade deals could ripple through the gold market.

• Interest Rate Decisions: Lower rates often mean more fuel for gold’s upward momentum.

• Market Sentiment: When uncertainty rises, so does the allure of gold.

With gold flirting with record highs, it’s clear that this metal still holds its shine—especially in times like these. 💎

🚀 Insider Sell-Off Hits Record as S&P 500 Climbs💸

The S&P 500 just hit another record high, fueling optimism among investors. But while markets are rallying, corporate insiders are quietly selling shares at an unprecedented pace—a move that raises eyebrows about the sustainability of this surge.

So far this month, insiders in 447 companies have sold shares, compared to insider buying in just 98 firms. That puts the buy-sell ratio at 0.22, the lowest level recorded since 1988. Most of the selling is concentrated in tech stocks, which have seen massive gains over the past two years. Insiders could simply be cashing in on profits, but the scale of the sell-off hints at broader caution.

The Flip Side: Corporate Buybacks Boom 🛒

At the same time, companies are aggressively buying back their own shares. This month alone, US companies have announced $48 billion in buybacks, marking the strongest January since 1999. Giants like General Electric, Netflix, and Citigroup are leading the charge.

Buybacks often serve to stabilize share prices, especially when insiders are offloading stocks. While they can signal corporate confidence, some analysts argue that diverting cash toward buybacks instead of reinvestment in growth could indicate a lack of long-term conviction.

Market Optimism vs. Insider Caution

Investors are focused on the positives—falling inflation, optimism around the Fed, and broadening participation in the S&P 500 rally. But insider activity is a red flag that can’t be ignored.

• Tech valuations stretched: After years of dominance, tech stocks may be overextended, making insiders more eager to lock in profits.

• Past signals matter: Historically, insider selling spikes have preceded market corrections, while buying sprees have marked bottoms.

For traders, this insider behavior offers critical lessons:

1. Pay attention to insider trends: Large-scale selling can be an early warning sign of market shifts.

2. Don’t ignore buybacks: While they may support share prices in the short term, they’re not always a sign of long-term confidence.

3. Stay balanced: Market sentiment is optimistic now, but with valuations running hot, caution is key.

Insider selling might not mean an immediate market reversal, but it’s a signal worth watching in an increasingly uncertain market landscape.

MEMES OF THE DAY

When the market humbles you faster than you can say ‘easy profits.’ 🤦♂️

Trading is trading… I guess 😂