Professional traders are always looking for options to improve their technical analysis with better forms of technical indicators and chart patterns. The idea is to provide more insight into the market that will reveal if assets will rise during times of financial turmoil. Most prefer to implement candlestick patterns in their trading strategy to get a better grasp of price action.

The benefit of using candlestick patterns is that they display the sentiment of the market and trends in prices. When used as a part of an integrated strategy that combines other indicators it has the potential for a favorable result in a trading session.

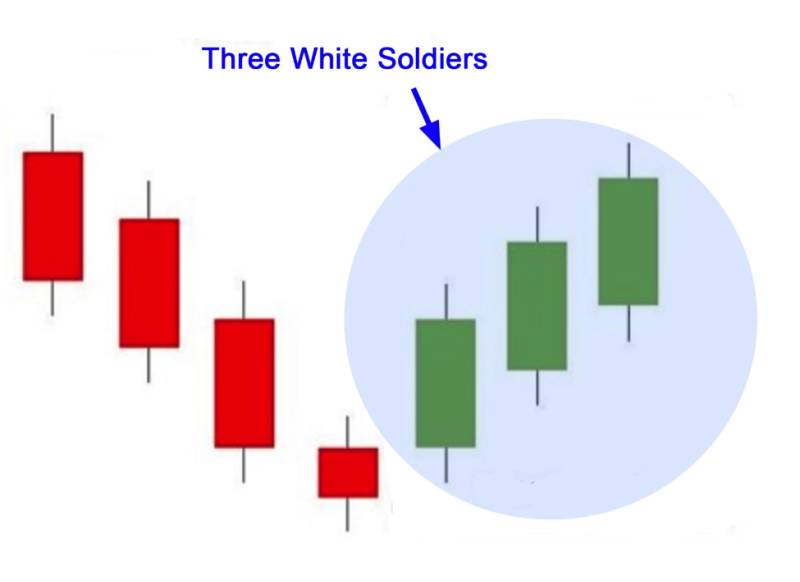

Several patterns are at investors’ disposal, and one of them is named three white soldiers, which usually happens when a stable downtrend is changing course and developing into a stable uptrend.

It’s a bullish candlestick pattern that gets implemented to forecast a reversal of the present downtrend in a price chart. The pattern gets formed from 3 successive candlesticks, which start in the preceding candlestick body and a close that exceeds the preceding candle’s high.

The candlesticks don’t need to possess long shadows, and in a perfect situation start in the real body of the previous candle of the pattern.

Also Read: Spinning Top Candlestick: A Complete Guide

Contents

- What Is the Three White Soldiers Pattern?

- Identifying the Pattern

- What Traders Learn from the Pattern?

- Identifying Entry and Exit Points

- Limitations of the Three White Soldiers

- Trading Conditions for the Three White Soldiers Candlestick Pattern

- Conclusion

- FAQs

What Is the Three White Soldiers Pattern?

As previously mentioned it qualifies as a bullish reversal pattern, created from 3 successive candles, which usually are white in color or green, depending on the trading software that gets used, and signals strong buying pressure that results in a reversal of a trend.

Typically the pattern emerges at the bottom of a downtrend, the candles that form the pattern are all long.

Frequently it’s utilized as an indicator for a reversal of a downtrend because it forms a favorable ratio of reward to risk.

The candles generally have an identical size during the opening of every candle is over the opening of the preceding candle. The strong purchasing pressure indicates a forthcoming uptrend.

In some circles the pattern is called three advancing white soldiers and this is due to the ability to signal the completion of a downtrend and signals an evident symptom in the stability of transition from sellers to buyers.

The contrary of the 3 white soldiers is named the three black crows pattern and is signals a bear market. Both are reversal patterns.

In the case of this pattern, it’s displayed with 3 successive typically black or red candles that create the top of an uptrend. It emerges if 3 bearish candles pursue a vigorous uptrend, implying that a reversal is in progress.

With the three white soldiers, traders get a signal that bulls are dominating, and the three black crows indicate a bearish candlestick pattern.

Identifying the Pattern

When more candlesticks are in play, things get more complicated when traders need to locate a trend. And with 3 candlesticks that form the three white soldiers, it can be a challenge. There are a few elements that have to be present to be able to identify the pattern.

- The pattern consists of 3 successive bullish candlesticks.

- The candles have to open and close higher than the preceding candle.

- All three candles should not have wicks, signaling buyers are controlling the market.

- The body of the second candle has to be larger than the initial candle in the pattern.

- The candles number two and three must-have roughly the identical length.

- The pattern emerges at support when three consecutive long bullish candles go for a downtrend and indicate a period of reversal to rally.

What Traders Learn from the Pattern?

The obvious thing an investor discovers with the trend is that the market is in a bullish reversal phase, signaling that bears are no longer dominant, and expectations are that there will be a trend reversal.

With the pattern, every candle has to be over the close of the preceding candle creating a staircase and every step goes higher than the preceding day. With the following candlestick having the middle price range of the preceding day.

The pattern’s upward trajectory signals of the pattern signal the start of an uptrend.

The three white soldiers’ pattern is reliable and productive when used in combination with other indicators. It’s practical for trading strategies and investors can incorporate elements like volume.

With the pattern, investors can start a trade, and at the same time, it can be used to leave a position. An example would be if an investor will join a long position when the three white soldiers candlestick emerges on a candlestick charts and the following candle displays a gap up opening.

It’s practical for intraday trading with short period time frames. Following the start of the long position, it’s recommended to have a stop-loss and take profit if there is an indication for reversal of the trend.

Realistically it’s not easy to locate the pattern, yet it’s beneficial, and traders should attempt to identify it and use the data provided for improving their trading strategy.

Also Read: What Is The Three Drives Pattern

Identifying Entry and Exit Points

There are various options to trade the three white soldiers pattern. Typically, two methods are available for any trader, such as use: A buy position gets started after the highest price of the three candles is broken, and purchasing the pullback.

The pattern can get used as an entry when traders plan to start a long position. Be a tool for investors that want to follow the dominant downtrend and find exit pints with the reversal price signal.

Traders will usually end short positions if they recognize the three consecutive bullish candlesticks on the price chart.

With a large higher move higher that displaces the three white soldiers pattern it frequently results in an overbought market. In this type of situation, it is practical to use technical indicators that offer extra context about what is occurring in the market.

Limitations of the Three White Soldiers

Three white soldiers can emerge in times of strengthening, and this is a period when traders can get cornered in the perpetuation of the current trend and not the reversal.

The focus needs to be on the volume that helps the creation of the 3 white soldiers. Patterns on low volume are doubtable and the reason is the market action of the few and not the many.

To tackle the disadvantages of visual patterns, investors rely on the 3 white soldiers and similar candlestick patterns that get used in tandem with other technical indicators.

Investors may search for zones of approaching resistance and start a long position after that area is spotted, alternatively, they can check the level of volume and verify that there is a large amount of currency traded.

When the pattern happens on low volume with nearby resistance, investors can stay patient and look for new verification of breakout before starting a long position.

Trading Conditions for the Three White Soldiers Candlestick Pattern

Several factors have to meet, so the pattern can get located on a chart:

The first condition is for the candle to look like propagation of the downtrend. As a bullish candlestick, the closing price needs to be higher than the opening price and signals the bulls are returning in the market.

The second condition is that candle number two needs to be bullish. In this case, the opening price has to be in the body of the initial candlestick, hopefully in the midpoint and closing price of the preceding candlestick, while the closing price has to be over the preceding candle’s closing price and must go higher than the closing price of the preceding candle.

The third condition relates to candlestick number 3 which has to be bullish without a shadow or one that’s relatively small. In this case, the opening price will be in the body of candlestick number 2 the best option is among the midpoint and closing price of candlestick number two.

And the closing price will go over the closing price of the preceding candle. The second and third candlestick have very similar conditions.

Conclusion

The recommendation for traders is that as a bullish pattern the three white soldiers candlestick pattern is a very practical instrument that needs to be incorporated in trading strategies.

Traders that implement Japanese candlestick charting techniques know that the previous candle’s closing price is important for the right context.

It’s not too difficult to locate the pattern if you know the required parameters that are necessary to spot the pattern on the chart.

And once identified it reveals important data that can make it easier to gauge the market sentiment. It’s useful for identifying trend reversals of the bullish type.

Some investors use the pattern to locate opportune entry points in the market. The pattern is established at the end of a downtrend and is a signal of a change in the status quo from the sellers to the buyers. Making it a useful instrument for defining a reversal of price after a downtrend.

The pattern can be a great ally if it’s used daily to look for upward movement. Most patterns are reliable only if they are used in combination with other technical indicators and the same principle applies to the three white soldiers pattern. If there are difficulties in working with the setup, newbie investors can practice the pattern with demo accounts.

FAQs

What do 3 White Soldiers Mean?

The 3 white soldiers is a bullish candlestick pattern that gets used to forecast a reversal in a present downtrend in a pricing chart.

How do You Trade 3 White Soldiers?

The important step is to verify the pattern on a chart, and for trading, you will need an account on a trading platform, where you can choose the asset you what to trade, select the position size and decide to buy or sell,

What Will Happen After 3 White Soldiers?

Following the 3 white soldiers, there will be a short period of consolidation.

What Does 3 Candles Mean?

The three candles signal the strength of bullish momentum.