Looking for the best CFD brokers to boost your trading in 2025? We've got you! With so many brokers out there, choosing the right one can feel overwhelming, but we're here to simplify things. Our team at Asia Forex Mentor has carefully reviewed the top 10 CFD brokers for this year, looking at their fees, features, trading tools, and more to help you make the right choice.

Whether you’re starting your trading journey or have plenty of experience, choosing the right broker is a key step toward achieving your goals. We’ll help you find the top platforms that can help you trade smarter, lower your exposure to loss, and reach your financial targets.

What is CFD Trading and Why Does It Matter?

CFD trading , or Contracts for Difference, allows traders to speculate on the price movements of various financial instruments without owning the underlying asset. This method involves predicting whether the price of an asset, like stocks, currencies, or commodities, will go up or down and entering into a contract based on that prediction. If the price moves in the trader's favor, they profit; if it moves against them, they incur a loss.

Advantages of CFD trading include the ability to trade on margin, meaning traders can open positions with a fraction of the total value, potentially amplifying profits. Additionally, CFDs provide the flexibility to go long (buy) or short (sell), making it easier to profit in both rising and falling markets. However, there are also disadvantages, such as the risk of high leverage, which can magnify losses.

Key terms in CFD trading include leverage, which allows traders to control a large position with a smaller amount of capital, and pips, which measure the change in currency values. Traders also need to understand concepts like lot sizes—the amount traded—and the importance of stop-loss orders to manage potential losses. These fundamentals are crucial for anyone considering CFD trading, helping ensure they are prepared for both the opportunities and risks involved.

How to Choose the Best CFD Broker for Your Needs

When choosing the best CFD broker, it’s essential to consider several factors to ensure a smooth, positive trading experience overall. Key factors include fees, platform features, and user experience, all of which directly impact a trader’s success and trading confidence. Seek brokers offering competitive spreads and low commissions, since high fees reduce profits and hurt long term performance across multiple trades. A trading platform must be user-friendly, with real-time quotes, technical analysis tools, and reliable order execution ensuring smooth functionality.

Regulation and security matter greatly when selecting a CFD broker. Ensure your broker is regulated by authorities like FCA, ASIC, or CFTC. Proper regulation ensures brokers follow strict standards, offering traders peace of mind that their accounts are handled responsibly and transparently always. Regulated brokers segregate client funds from operational funds, protecting your investment even if the broker experiences financial problems or insolvency.

It’s also vital to consider the types of assets available when choosing a broker for CFD trading opportunities and flexibility. The best brokers offer instruments like Forex, stocks, indices, commodities, and cryptocurrencies, providing multiple choices for traders seeking market exposure. Diverse assets help diversify portfolios effectively, reduce risks, and maximize opportunities while allowing traders to explore broader global market trends confidently.

How the Asia Forex Mentor Team Ranked the Best CFD Brokers

When selecting the best CFD brokers for 2025, the Asia Forex Mentor team considered several key factors to ensure traders have a secure and effective trading experience in these best CFD trading platforms. Here is an overview of the main criteria used for evaluation:

- Regulation and Security:

- Brokers must be regulated by recognized financial authorities such as the FCA (UK), ASIC (Australia), CySEC (Cyprus), or CFTC (USA). This ensures compliance with strict financial standards, providing a safer trading environment.

- The presence of robust security measures, like encryption protocols and the segregation of client funds, is also critical to protect traders' personal and financial data.

- Fees and Commissions:

- The selection process involved comparing spreads, commissions, and other trading-related fees. Brokers offering low or zero commissions, competitive spreads, and transparent fee structures were prioritized.

- Consideration was given to additional costs, such as overnight fees or inactivity charges, which could impact a trader’s overall profitability.

- Platform Features and User Experience:

- A user-friendly trading platform with essential features like real-time price quotes, advanced charting tools, technical analysis tools, and efficient order execution was considered important.

- Platforms that offer mobile trading capabilities, allowing for flexible trading on the go, were rated higher.

- The quality of customer support, including availability, responsiveness, and the ability to resolve issues promptly, was also a significant factor.

- Range of Tradable Assets:

- Brokers were evaluated based on the diversity of assets available for CFD trading, including Forex, stocks, indices, commodities, and cryptocurrencies. A wider range of assets allows traders to diversify their portfolios and manage risk effectively.

- Leverage and Margin Options:

- The availability of various leverage and margin options was considered, with brokers offering flexible leverage terms being preferred. This is particularly important for traders looking to maximize their market exposure with smaller capital.

- Reputation and Customer Feedback:

- The overall reputation of the broker, including its history, market presence, and customer feedback, was analyzed. Positive reviews from experienced traders and a strong track record of service quality added to the broker's score.

- Educational Resources and Tools:

- Brokers that provide comprehensive educational resources, such as tutorials, webinars, market analysis, and trading tools, were favored. These resources are valuable, especially for beginner traders who are looking to enhance their knowledge and skills.

- Execution Speed and Reliability:

- The speed and reliability of trade execution were crucial criteria. Brokers that minimize slippage, provide consistent order execution and maintain platform uptime were ranked higher.

The 10 Best CFD Brokers in 2025

#1. AvaTrade

What is AvaTrade?

AvaTrade is a globally recognized online broker established in 2006, known for its comprehensive platform that supports trading across various financial markets, including Forex, commodities, indices, stocks, bonds, ETFs, and cryptocurrencies. AvaTrade is a popular choice due to its commitment to providing a user-friendly experience, a wide range of trading tools, and multiple platform options like MetaTrader 4, MetaTrader 5, and its proprietary AvaTradeGO app. The broker is regulated by several top-tier financial authorities worldwide, ensuring a secure trading environment. AvaTrade's support for multiple account types, including Islamic accounts, makes it suitable for both beginners and experienced traders.

Advantages and Disadvantages of AvaTrade

AvaTrade Commissions and Fees

AvaTrade operates on a spread-only basis, meaning it does not charge additional commissions for trades. Instead, trading costs are integrated into the spread—the difference between the buying and selling price of an asset. However, AvaTrade's spreads can sometimes be slightly higher than those of competitors. The broker also imposes an inactivity fee of $50 per quarter after three months of non-use and an administration fee if the account remains inactive for 12 months.

OPEN AN ACCOUNT NOW WITH AVATRADE AND GET YOUR WELCOME BONUS

#2. XM

What is XM?

XM is an international online trading broker established in 2009. It operates in more than 190 countries and has built a solid reputation in the financial industry. XM is regulated by ASIC, CySEC, and IFSC, which gives traders the option to work with its global entities under strict oversight. The broker is known for its fast trade execution, flexible account types, and access to over 1,000 trading instruments, such as forex, CFDs, indices, commodities, stocks, and cryptocurrencies. With multi-language support and beginner-friendly platforms, XM has become a preferred choice for both new and experienced traders.

Advantages and Disadvantages of XM

XM Commissions and Fees

XM’s commissions and fees depend on the account type: the Micro and Standard accounts are commission-free with spreads starting from 1 pip, while the Zero Account charges from $3.50 per lot per side in return for spreads as low as 0.0 pips. The Shares Account has its own structure, with commissions such as 0.04% per share for US stocks (minimum $1), 0.1% for UK stocks (minimum $9), and 0.1% for German stocks (minimum $5). Other costs include swap fees for overnight positions and a $10 monthly inactivity fee after 90 days of no trading, but deposits and withdrawals are free, with XM covering bank transfer fees on deposits over $200.

OPEN AN ACCOUNT NOW WITH XM AND GET YOUR WELCOME BONUS

#3. Admirals

What is Admirals?

Admirals, formerly known as Admiral Markets, is a well-regarded online broker with a strong presence in the Forex and CFD trading industry since 2001. It offers traders a variety of trading instruments, including Forex, commodities, indices, stocks, and cryptocurrencies, through popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Admirals is highly regulated by reputable authorities, including the FCA and CySEC, ensuring a secure trading environment. The broker is known for providing a comprehensive range of educational resources, round-the-clock customer support, and flexible account options, making it a good choice for both beginners and experienced traders.

Advantages and Disadvantages of Admirals

Admirals Commissions and Fees

Regarding commissions and fees, Admirals has a varied fee structure depending on the type of account and assets being traded. Forex and metals on the Zero MT4 account have a commission ranging from $1.8 to $3.0 per lot. There are also specific fees for trading indices, energies, and stocks. Additionally, an overnight or swap fee is charged when positions are held for more than a day. Admirals offers an Islamic account option that eliminates swap fees, replacing them with an administrative fee, which caters to diverse trader needs while maintaining transparency in costs.

OPEN AN ACCOUNT NOW WITH ADMIRALS AND GET YOUR WELCOME BONUS

#4. Interactive Brokers

What is Interactive Brokers?

Interactive Brokers is a well-established online brokerage firm known for its wide range of investment options, including CFDs. Founded in 1978, it offers access to numerous global markets and provides advanced trading platforms like Trader Workstation (TWS), which is ideal for active and professional traders. Regulated by top-tier authorities like the SEC, FINRA, and CFTC, Interactive Brokers ensures a high level of security and transparency, making it a reliable choice for trading.

Advantages and Disadvantages of Interactive Brokers

Interactive Brokers Commissions and Fees

Interactive Brokers uses a tiered pricing model based on trading volume. For stocks, ETFs, and warrants, fees range from $0.0035 to $0.0005 per share, depending on monthly volume. For options and futures, fees reduce with higher volumes. Clients get one free withdrawal per month; subsequent withdrawals incur fees, varying by method and currency. An inactivity fee is charged if the account balance is below $2,000 and generates less than $20 in commissions monthly. Checking the broker’s website is recommended for updated details on costs and fees.

OPEN AN ACCOUNT NOW WITH INTERACTIVE BROKERS AND GET YOUR BONUS

#5. Pepperstone

What is Pepperstone?

Pepperstone is a well-regarded CFD broker known for its competitive pricing, fast execution speeds, and reliable trading infrastructure. Founded in 2010, Pepperstone offers access to a wide range of markets, including forex, commodities, cryptocurrencies, and indices. Regulated by the FCA and ASIC, it ensures a secure trading environment with a variety of platforms, such as MetaTrader 4 and 5. Pepperstone is ideal for traders seeking low-cost trading with high-quality service.

Advantages and Disadvantages of Pepperstone

Pepperstone Commissions and Fees

Pepperstone offers a competitive fee structure. The Razor account has spreads as low as 0.0 pips with a commission of $3.50 per side per lot, while the Standard account has wider spreads but no commissions. There are no fees for deposits or most withdrawals, but an inactivity fee of $15 is applied after six months of no activity.

OPEN AN ACCOUNT NOW WITH PEPPERSTONE AND GET YOUR WELCOME BONUS

#6. Exness

What is Exness?

Exness is a global brokerage firm established in 2008, known for its diverse range of trading instruments, including over 120 currency pairs, stocks, cryptocurrencies, and commodities. Regulated by multiple financial authorities, such as CySEC and the FCA, Exness provides a secure and reliable trading environment. The broker offers flexible leverage options up to 1:2000 and features like instant withdrawals, low commissions, and a variety of account types suitable for different trading needs, making it a popular choice among traders worldwide.

Advantages and Disadvantages of Exness

Exness Commissions and Fees

Exness primarily operates with tight spreads, which can be as low as 0.0 pips on certain accounts. The broker does not charge commissions on most account types, but specific accounts, like the Raw Spread account, involve commissions starting from $3.50 per side per lot. Additionally, Exness does not charge fees for deposits or withdrawals, which helps traders manage costs effectively. However, traders should be aware that higher leverage options might carry more risk, especially for those with smaller deposits.

OPEN AN ACCOUNT NOW WITH EXNESS AND GET YOUR WELCOME BONUS

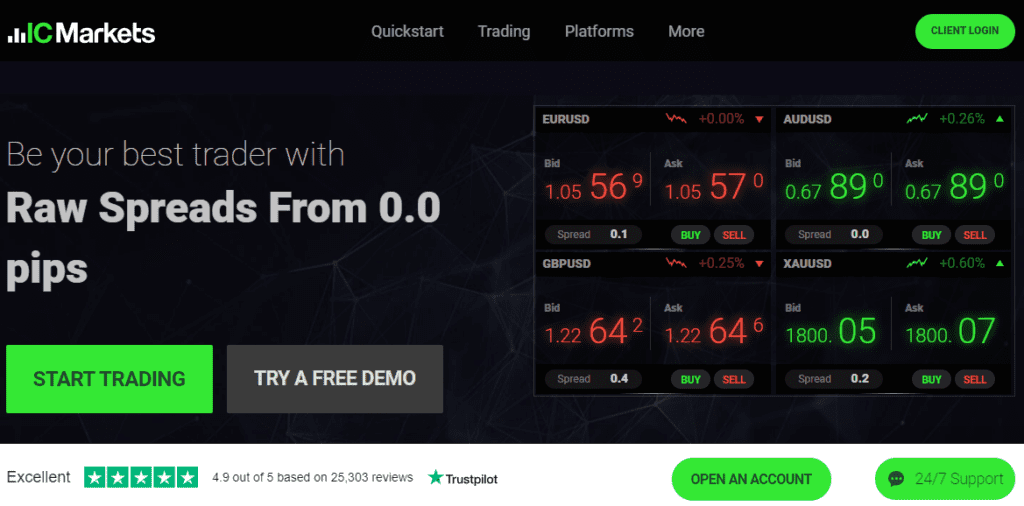

#7. IC Markets

What is IC Markets?

IC Markets is a well-regarded CFD broker known for offering a wide range of trading instruments, including Forex, commodities, indices, cryptocurrencies, bonds, and futures. Established in 2007 and regulated by reputable authorities like ASIC, CySEC, and the FSA, IC Markets provides a secure trading environment. The broker is particularly popular among algorithmic traders due to its fast execution speeds, low latency, and competitive pricing, making it ideal for both retail and institutional traders who seek a reliable and cost-effective platform.

Advantages and Disadvantages of IC Markets

IC Markets Commissions and Fees

In terms of commissions and fees, IC Markets is known for its competitive fee structure. The broker offers three types of accounts: Standard, Raw Spread, and cTrader, each with different pricing models. The Standard account is commission-free, relying on slightly higher spreads, while the Raw Spread and cTrader accounts charge a commission starting at $3.50 per lot per side, with spreads as low as 0.0 pips. The broker does not charge fees for deposits or withdrawals, except for international bank transfers which incur a fee of $20. Additionally, IC Markets has no inactivity fees, making it cost-effective for both active and occasional traders.

OPEN AN ACCOUNT NOW WITH IC MARKETS AND GET YOUR WELCOME BONUS

#8. Tickmill

What is Tickmill?

Tickmill is a globally recognized CFD broker known for its low-cost trading environment, making it an attractive choice for both beginner and experienced traders. Established in 2015, Tickmill is regulated by the FCA, CySEC, and FSA, ensuring traders a secure trading environment. It provides MetaTrader 4 and MetaTrader 5, delivering smooth execution, advanced tools, and strong support for diverse trading strategies. Tickmill offers Forex, stocks, indices, commodities, and bonds, giving traders portfolio diversity and access to multiple global financial markets.

Advantages and Disadvantages of Tickmill

Tickmill Commissions and Fees

The broker offers three types of accounts for trading CFDs: Classic, Pro, and VIP. The Classic account has no commissions, with costs included in the spreads, which start from 1.6 pips. The Pro and VIP accounts offer spreads starting from 0.0 pips, but a commission is charged at $2 per side per lot for the Pro account and $1 per side per lot for the VIP account. Tickmill does not charge fees for deposits or withdrawals, but it is important to note that some payment methods may incur external charges depending on the provider.

OPEN AN ACCOUNT NOW WITH TICKMILL AND GET YOUR WELCOME BONUS

#9. XTB

What is XTB?

XTB is a leading CFD broker in Europe, known for its diverse range of over 2,100 tradable assets, including stocks, forex, commodities, indices, and cryptocurrencies. Founded in 2002, XTB is regulated by the FCA in the UK and FSC in Mauritius, ensuring strong security for traders. The broker is recognized for its proprietary trading platform, XStation 5, which is user-friendly and offers advanced tools for traders. This combination makes XTB a reliable choice for both beginners and experienced traders seeking simplicity, speed, and powerful trading management features.

Advantages and Disadvantages of XTB

XTB Commissions and Fees

XTB generally offers competitive spreads, with averages under 1.5 pips for standard accounts. Spreads can start from 0.5 pips, but they vary frequently. While there is no explicit commission for most trades, the broker takes a portion of the spread. Additional costs include a monthly maintenance fee of 10 EUR for inactive accounts and varying swap and withdrawal fees, depending on the user's region and account conditions.

OPEN AN ACCOUNT NOW WITH XTB AND GET YOUR WELCOME BONUS

#10. FXPro

What is FXPro?

FXPro is a well-known CFD broker established in 2006, offering a wide range of instruments across six asset classes. These include forex pairs, indices, metals, energies, shares, and futures, giving traders multiple options to diversify and strengthen trading strategies. FXPro is regulated by respected authorities like the FCA in the UK and CySEC in Cyprus, ensuring strong security protections. The broker is valued for robust trading infrastructure, offering MetaTrader 4, MetaTrader 5, cTrader, and its own proprietary FXPro platform. This combination makes FXPro an excellent choice for traders seeking fast execution, advanced features, and diverse tools supporting consistent trading performance.

Advantages and Disadvantages of FXPro

FXPro Commissions and Fees

FXPro does not charge fees for deposits or withdrawals, but it does have an inactivity fee after 12 months of non-use. The broker offers various pricing models depending on the platform and account type. For example, accounts on cTrader are subject to a commission of $4.50 per lot, while MetaTrader accounts have the costs embedded in spreads that can start as low as 0.6 pips. FXPro provides competitive pricing, but fees may be higher compared to some other brokers, especially for CFDs.

OPEN AN ACCOUNT NOW WITH FXPRO AND GET YOUR WELCOME BONUS

Tips for New CFD Traders: How to Get Started

For new CFD traders, it is crucial to start with a solid understanding of the basics of CFD trading.

>CFDs allow speculation on price movements without owning assets, making it important to know leverage, margin, and spread for informed trading. To begin, familiarize yourself with these concepts, as they form the foundation for making informed trading decisions in the market.

To manage risks effectively, traders should use strategies such as setting stop-loss orders to limit potential losses during volatile conditions. Avoid over-leveraging carefully, since it can amplify both gains and losses, creating unnecessary risks that threaten overall trading stability. Learning to read both fundamental and technical analysis helps predict market movements more accurately, supporting consistent, well-informed trading decisions.

Building confidence and experience requires time, patience, and discipline. Start by trading small positions to get comfortable with different market dynamics. Focus on developing a trading plan including risk tolerance, financial goals, and strategies for handling multiple possible market conditions effectively. As experience grows, gradually increase trade size and refine strategies based on actual trading performance, improving consistency and building confidence.

Conclusion

Choosing the right CFD broker is crucial for building a successful trading journey that supports growth and long term trading goals. In 2025, the Asia Forex Mentor team reviewed the top CFD brokers, analyzing fees, platform features, regulation, and customer support. Brokers like Pepperstone, AvaTrade, IC Markets, Tickmill, XTB, FXPro, Exness, and Interactive Brokers were recognized for exceptional services. These brokers provide competitive spreads, strong regulatory oversight, and user-friendly platforms, offering traders a reliable foundation for consistent trading success. They also offer diverse trading instruments, including forex, stocks, and cryptocurrencies, allowing traders to explore various strategies and trading preferences.

When selecting the best CFD broker, always evaluate regulatory status carefully, ensuring your funds remain protected under strict financial supervision. Consider the fees and commissions charged by brokers, as these costs significantly affect profitability and long term trading performance. Also review the platform’s available trading tools and instruments, since these features directly support learning, decision-making, and consistent execution. Assess the broker’s customer service quality carefully, because prompt and reliable assistance is vital, especially for beginners entering financial markets. The right CFD broker aligns with personal trading goals, creating a secure, efficient environment that helps traders thrive successfully in markets.